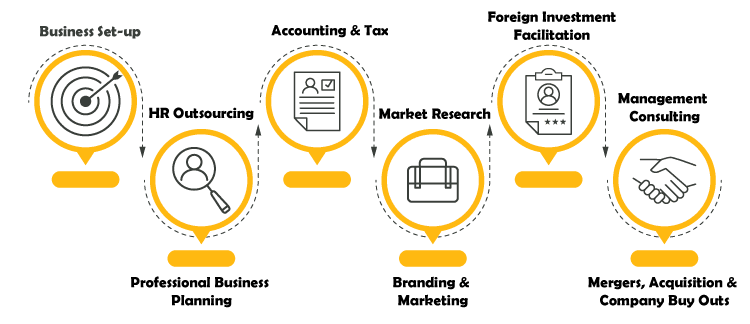

East Africa Business Consultants is an award Winning, Reliable, Customer-Centered and Innovative Business Consultants in Kenya with Branch Offices and Business Associates in the following countries in East & Central Africa: Burundi, Congo, Ethiopia, Ghana, Malawi Mozambique, Namibia, Rwanda, South Africa, Tanzania, Uganda, Zambia.

For about a Decade now, East Africa Business Consultants has focused on helping Local and Foreign Business owners Start, Grow and Exit their Businesses Professionally, Efficiently and Conveniently in Kenya, Central & East Africa. We are passionate about taking on immense Business challenges that matter to you our clients and often, to the world.